What's The Difference Between Life Insurance And Health Insurance?

It's no doubt that we are living in *special* times. We are living in the middle of a pandemic and tbh, no one really knows what could happen next. Not to sound all cheesy, but life truly is short. And if there's one thing I've learned this past year, it's that in times of uncertainty, it's always best to prepared. Now, more than ever, getting an insurance plan might just be one of the many things that should be taken into consideration. But how do you know what type of insurance you should get, and how do you figure out if it's *actually* right for you? In her latest vlog, Charm de Leon of Ready2Adult PH breaks it down for us.

What is insurance?

In an article published by Investopedia, the term insurance is basically defined as "a contract, represented by a policy, in which an individual or entity receives financial protection." According to Charm, "Insurance is set in place for things that are unexpected or tragic. Everyone needs insurance. It just depends on which one [is more suitable for you]." In Charm's video, she discusses the types of insurance under Life Insurances and Non-Life Insurances. Keep reading to know more.

The different types of insurance

Life Insurance

For some, this could also be known as "death insurance." Simply put, this is the kind of money your beneficiaries will receive in case of your demise.

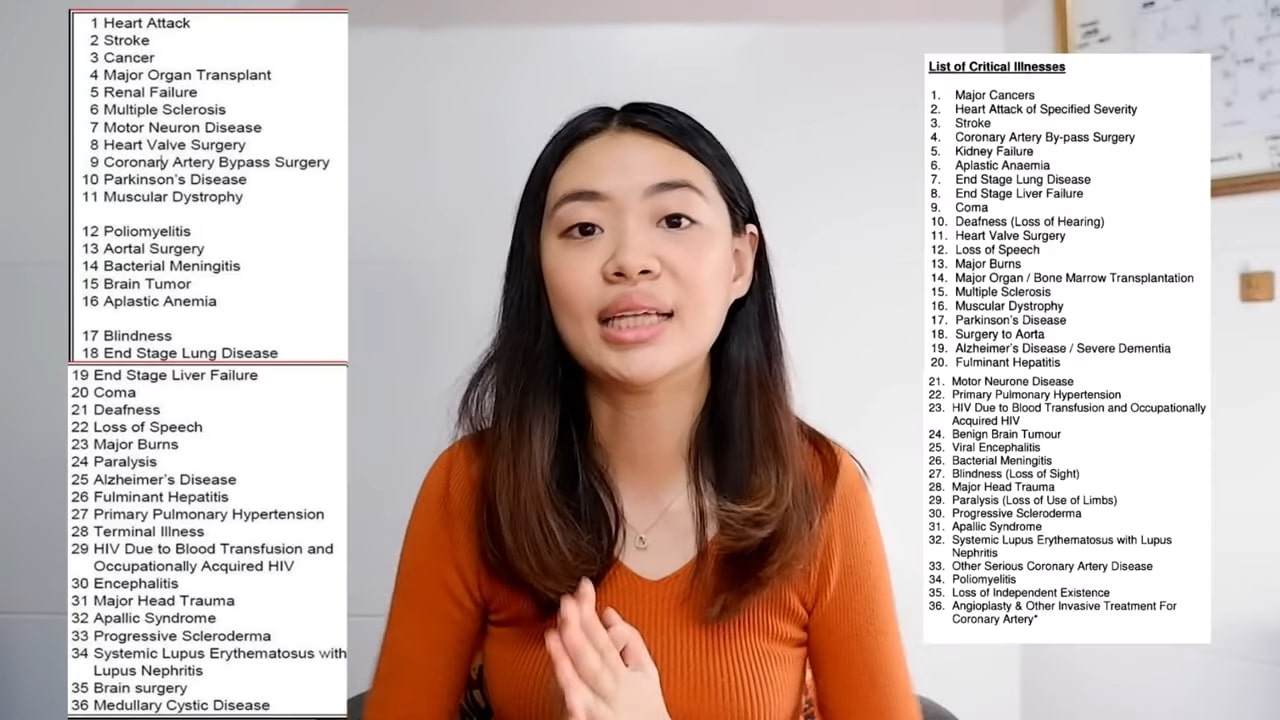

Criticial Illness Insurance

When you get sick with a critical illness, a lump sum amount will be given to you and your family. Different companies have varying policies so it's best to double check with your provider what illnesses are covered. "Most companies cover the cancer types, strokes, heart diseases, etc. There are also some companies that cover major or minor critical illnesses," Charm explained.

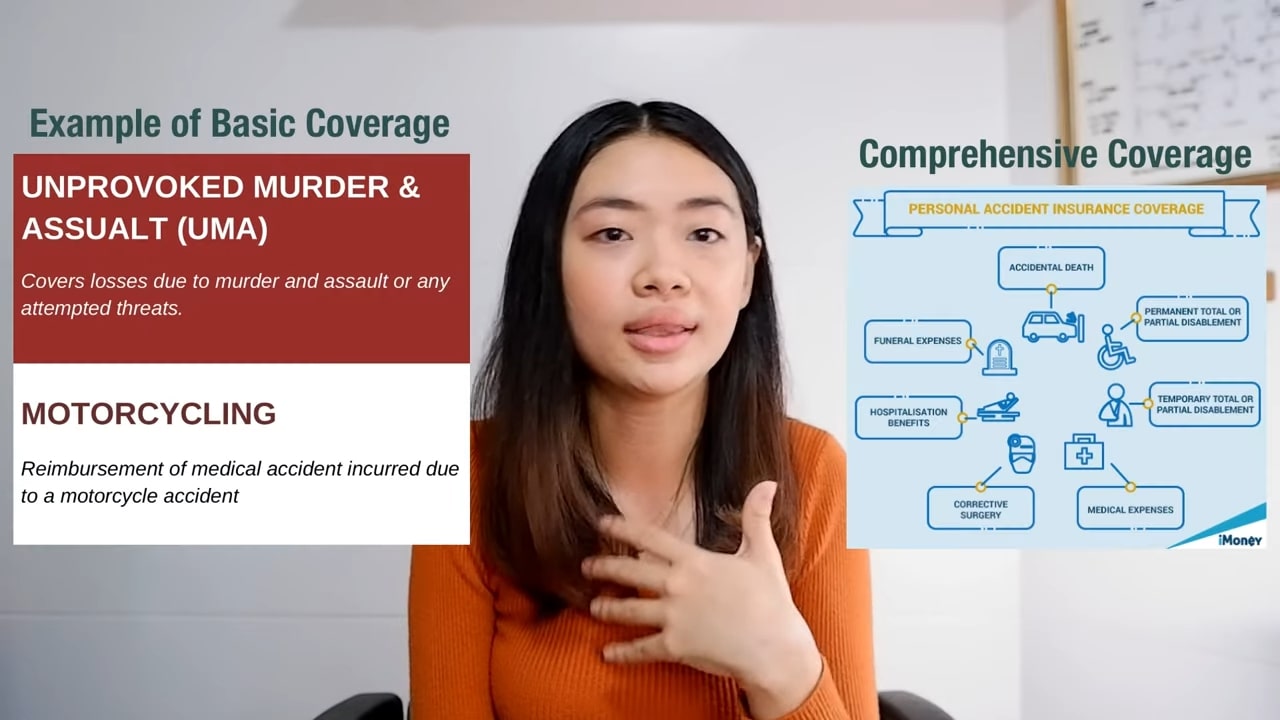

These refer to the policies that give you a certain amount when you get into accidents. Some of the basic coverage include motorcycle accident, unprovoked murder, and assault while a comprehensive coverage includes medical expenses, funeral expenses, and more.

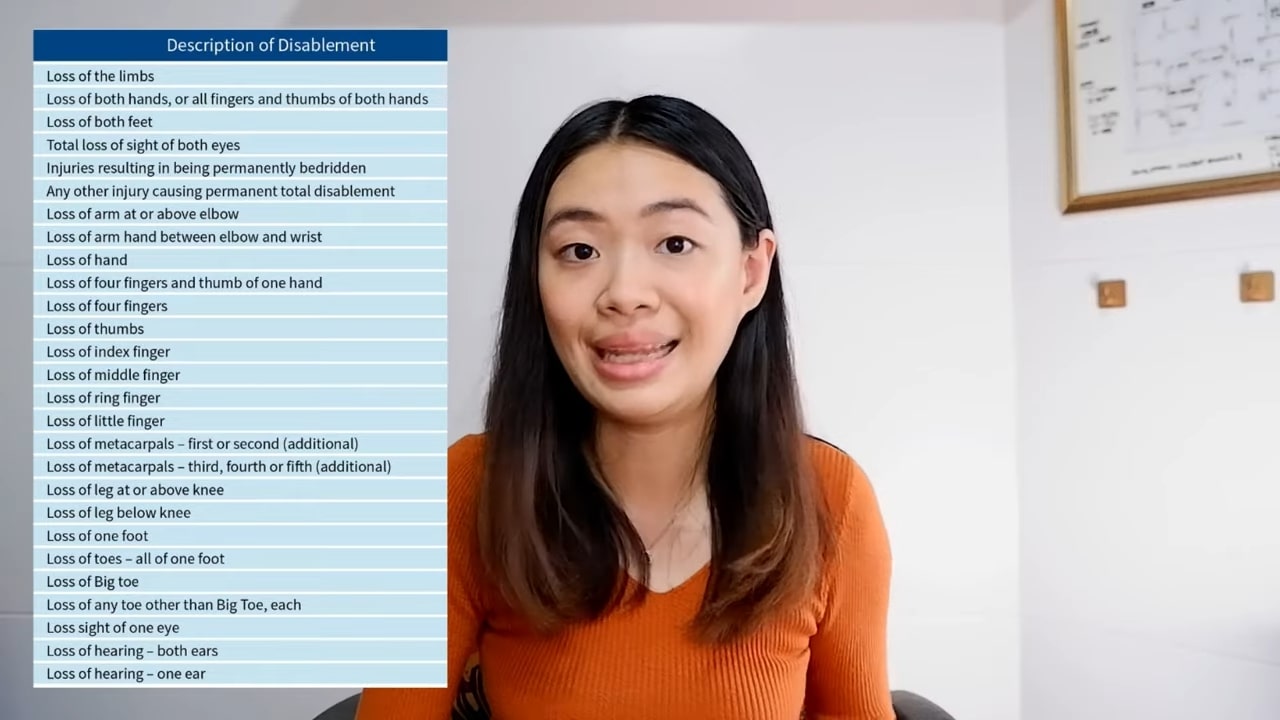

Total Or Permanent Disability/Dismemberment Insurance

This is when you get a lump sum amount in the tragic event that you lose a part of your body or experience total disability.

Health Insurance

Charm shared that this is the kind of insurance majority of us need because "it's really expensive to get sick, especially in the Philippines." Health insurance covers the cost of medical treatments, check-ups, hospitalization, and more.

Health Maintenance Org

A Health Maintenance Org (HMO) is basically a health insurance but it has a set amount per year. This set amount is called the Annual Benefit Limit (ABL). If you're currently employed, you can check with your HR Department if you have an HMO and see what your ABL is. And as a reminder, Charm said, "Please make sure to take advantage of your HMO because your company is paying for that!"

PhilHealth

This is the government's health insurance. Hospital costs, room subsidy, medicine, and professional fees are just some of the things it covers.

Travel Insurance

As the name suggests, this type of insurance gives you financial protection when you travel. In the event that you lose your baggage, experience delays, or get into an accident, these will be covered by your insurance.

Funerial And Burial Insurance

In case of a person's death, this type of insurance covers the funeral, burial, and cremation costs. Charm even shared that she came across an article that it costs around P50,000 to P200,000 to die in the Philippines.

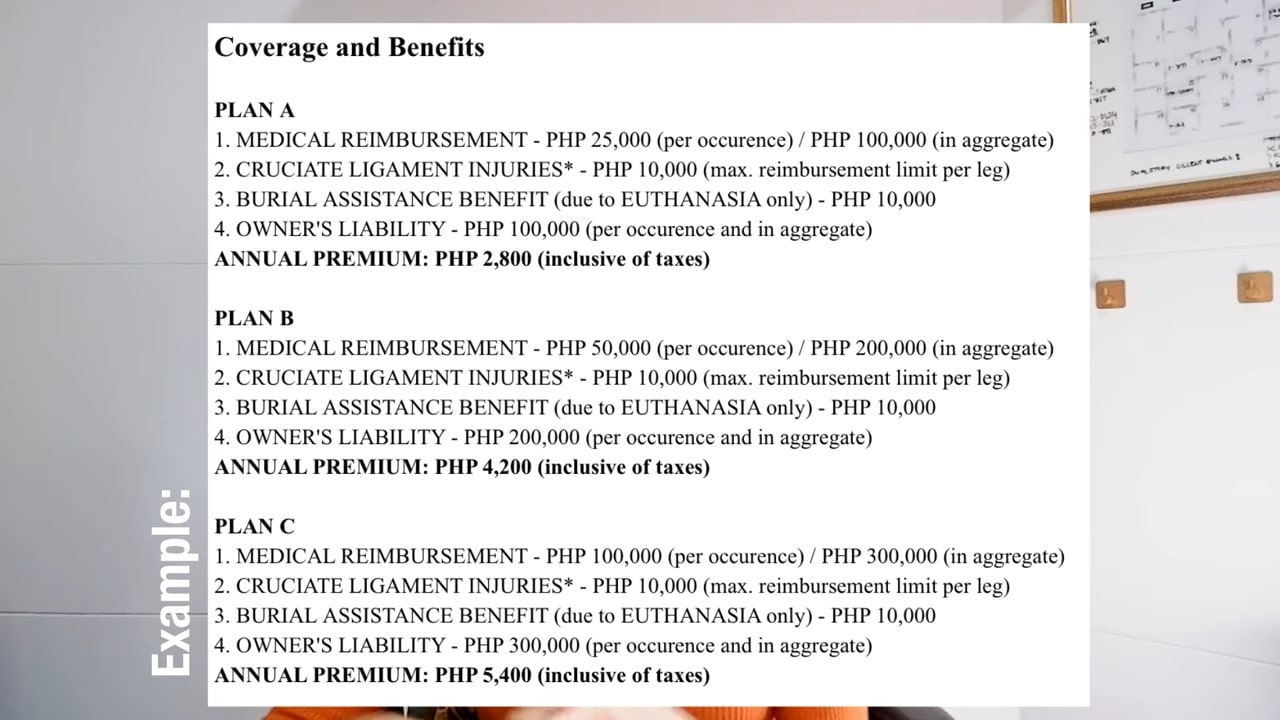

Pet Insurance

Calling all fur parents! This one's for you and your fur baby. Pet insurance is quite new in the country, but there are providers who cover hospital costs, medicine, and check-ups at the vet.

Vehicle Insurance

Filed under Non-Life Insurance, Vehicle Insurance has two types: Comprehensive Vehicle Insurance (which includes coverage for own damage) and Compulsory Third-Party Liability Insurance (CTPLI). CTPLI is the kind of insurance that's required yearly by the LTO when you renew your vehicle's OR.

Comprehensive General Liability Insurance (CGLI)

"Get this if you own a business," Charm advised. This type of insurance covers businesses that are charged legal fees and compensations for accidents, bodily injuries, or property damage for third parties.

Watch the video below to know more about the different types of insurance.

[youtube:{"videoId":"null","youtubeId":"t7-M3n5lNu8", "caption":""}]

***

Cosmopolitan Philippines is now on Quento! Click here to download the app and enjoy more articles and videos from Cosmo and your favorite websites!

Follow Lou on Instagram.

[ArticleReco:{"articles":["71520","77447","77465","77322"], "widget":"More from cosmo"}]

Source: Cosmo PH

Post a Comment

0 Comments